Free Friday

There has been recent popularity regarding time windows and it is one I completely agree with! There are certain structural changes that happen throughout the 24-hour session and as a trader, it is important to take note of these when designing a system or strategy (or just placing trades). For example, how is my strategy’s performance when Asia closes? How about when the US opens?

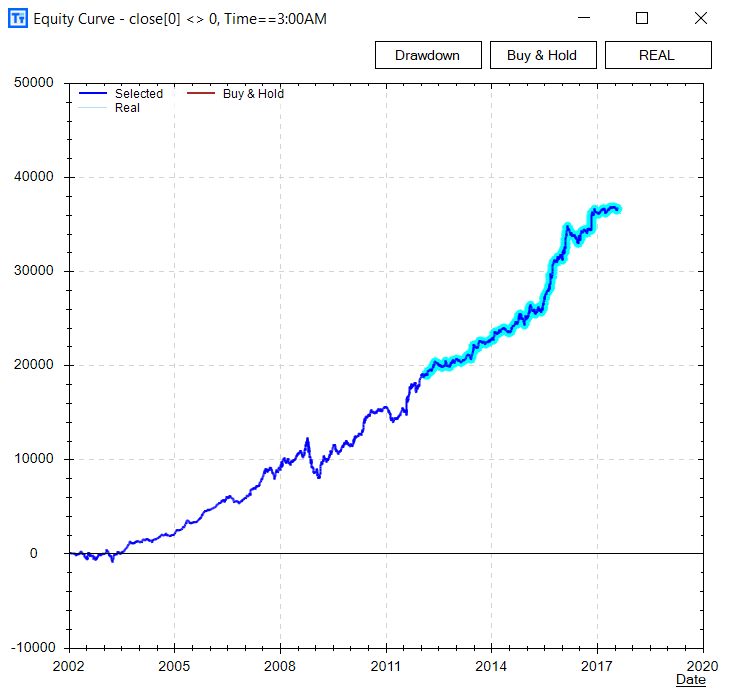

There are also some blatant market anomalies that still exist regarding time windows. The most obvious one, and often popularized by Eric Hunsader of Nanex (and others), is the S&P500 futures performance from 2 am to 3 am. This little one hour window looks like quite the edge – and has been persistent despite being publicly known for quite some time.

There are plenty of ways to use the time of the day to your advantage. For instance, only find trades/patterns that exist during a window of time where you might be at your desk. Another simple approach is to filter out unfavorable periods of the day to improve your performance (obviously proper testing methods important here).

My main point is… if you start paying attention to time windows you may be surprised as to what simple edges you’ll discover. It has certainly been a staple in my research for quite a while and knows many other successful traders who put a lot of emphasis on this.

I’ve recently upgraded Build Alpha to allow for intraday strategy creation and time window filtering (among other things). Inside BA you can now select (and create your own) time windows to use as input in the strategy creation engine. There is also a time of day test which allows you to select certain windows to see if it improves strategy performance.

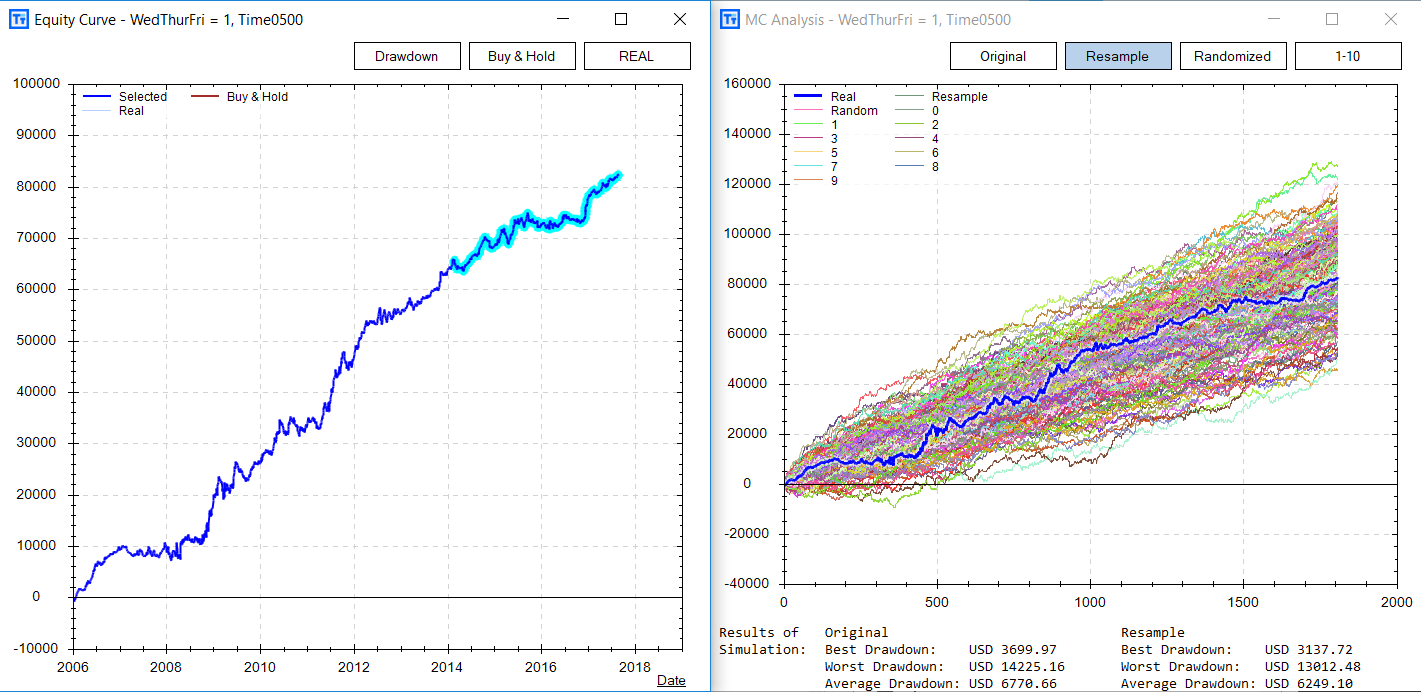

Below is a simple strategy that shorts EURUSD (I used the futures contract) at 5:00 am EST every Wednesday, Thursday, and Friday morning. This idea simply holds a short trade for 3 hours.

These might not be standalone strategies, but can certainly give you a head start for continued research, act as a filter for other strategies or be paired with other ideas to create fully operational strategies.

Trading is extremely competitive. Looking at price alone is may be too naïve in today’s market; there is simply too much computing power looking at it. If you’re struggling to find quantified edges then maybe it is time (pun intended) to start pairing price action with time filters.

As always, thanks for reading. And please stay safe with all these hurricanes!

Dave

There are plenty of ways to use the time of the day to your advantage. For instance, only find trades/patterns that exist during a window of time where you might be at your desk. Another simple approach is to filter out unfavorable periods of the day to improve your performance (obviously proper testing methods important here).

My main point is… if you start paying attention to time windows you may be surprised as to what simple edges you’ll discover. It has certainly been a staple in my research for quite a while and knows many other successful traders who put a lot of emphasis on this.

I’ve recently upgraded Build Alpha to allow for intraday strategy creation and time window filtering (among other things). Inside BA you can now select (and create your own) time windows to use as input in the strategy creation engine. There is also a time of day test which allows you to select certain windows to see if it improves strategy performance.

Below is a simple strategy that shorts EURUSD (I used the futures contract) at 5:00 am EST every Wednesday, Thursday, and Friday morning. This idea simply holds a short trade for 3 hours.

There are plenty of ways to use the time of the day to your advantage. For instance, only find trades/patterns that exist during a window of time where you might be at your desk. Another simple approach is to filter out unfavorable periods of the day to improve your performance (obviously proper testing methods important here).

My main point is… if you start paying attention to time windows you may be surprised as to what simple edges you’ll discover. It has certainly been a staple in my research for quite a while and knows many other successful traders who put a lot of emphasis on this.

I’ve recently upgraded Build Alpha to allow for intraday strategy creation and time window filtering (among other things). Inside BA you can now select (and create your own) time windows to use as input in the strategy creation engine. There is also a time of day test which allows you to select certain windows to see if it improves strategy performance.

Below is a simple strategy that shorts EURUSD (I used the futures contract) at 5:00 am EST every Wednesday, Thursday, and Friday morning. This idea simply holds a short trade for 3 hours.

These might not be standalone strategies, but can certainly give you a head start for continued research, act as a filter for other strategies or be paired with other ideas to create fully operational strategies.

Trading is extremely competitive. Looking at price alone is may be too naïve in today’s market; there is simply too much computing power looking at it. If you’re struggling to find quantified edges then maybe it is time (pun intended) to start pairing price action with time filters.

As always, thanks for reading. And please stay safe with all these hurricanes!

Dave[/vc_column_text][/vc_column][/vc_row]

These might not be standalone strategies, but can certainly give you a head start for continued research, act as a filter for other strategies or be paired with other ideas to create fully operational strategies.

Trading is extremely competitive. Looking at price alone is may be too naïve in today’s market; there is simply too much computing power looking at it. If you’re struggling to find quantified edges then maybe it is time (pun intended) to start pairing price action with time filters.

As always, thanks for reading. And please stay safe with all these hurricanes!

Dave[/vc_column_text][/vc_column][/vc_row]