Forex Algorithmic Trading Software

Gain the ability to test and improve your trading strategies to find the best entry and exit points. No coding required.

How Forex Algo Trading Works with BuildAlpha

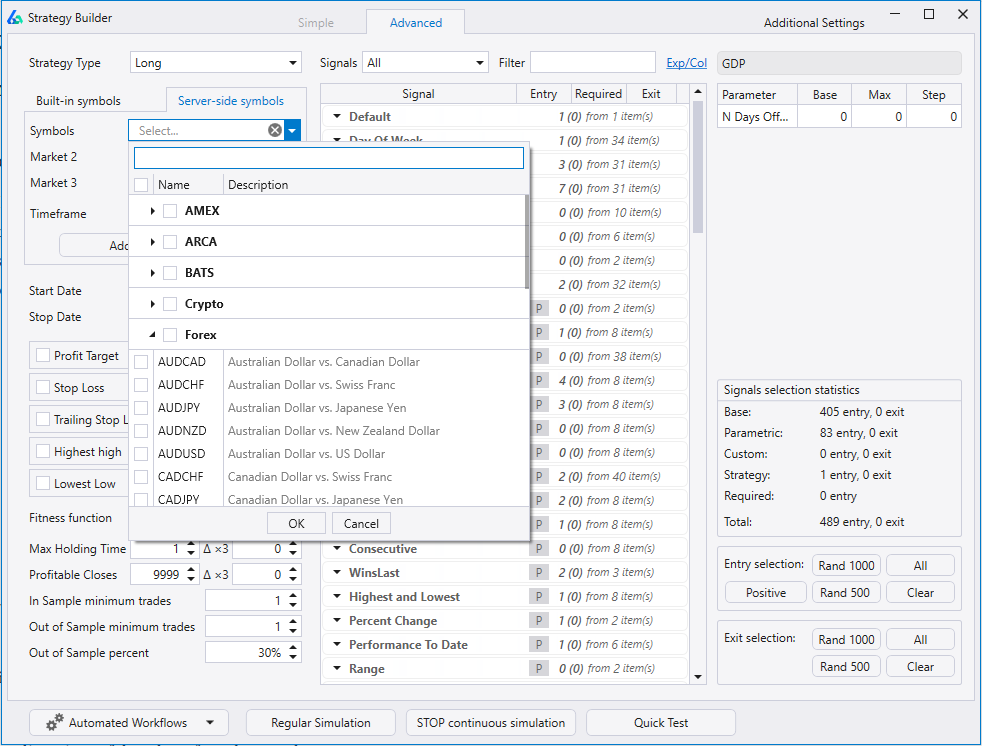

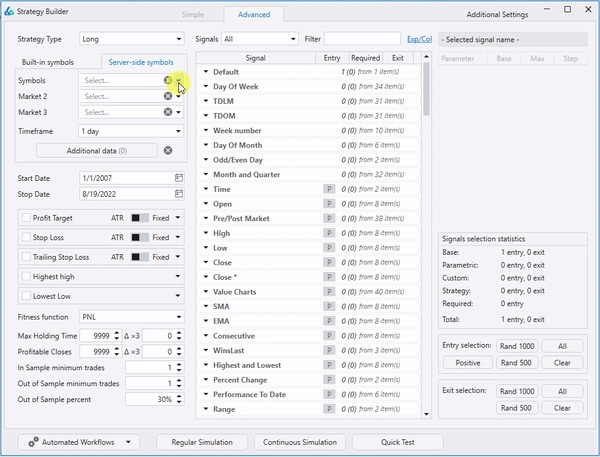

Step 1 – Select Currency Pairs and Timeframe Choose the symbol or symbols to build algo trading strategies for. Selecting a single currency pair will return the best strategies for that market. Selecting multiple currency pairs will return the best trading systems that work across that basket.

Step 2 – Entry and Exit Signals Build Alpha has over 6,000+ built-in entry and exit signals that can be completely customized and optimized. Here is a short list of what is available all point and click.

- Seasonality, time of day, weekday, month, quarter

- Price Action, Chart Patterns, Japanese Candlesticks

- Volume analysis, Volatility measures

- Full Technical Analysis library and Technical indicators

- Market breadth, Tick, TRIN, Internals

- Economic News and Events such as GDP, Jobs Reports, Inflation

- US Treasury Yields and Spreads

- Volatility Index Term Structure

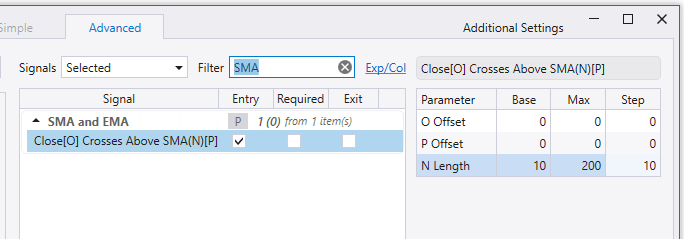

Traders can also set parameter ranges for optimization. The below example shows the Close crossing above the Simple Moving Average and would test the 10 period to 200 period SMA incrementing by 10.

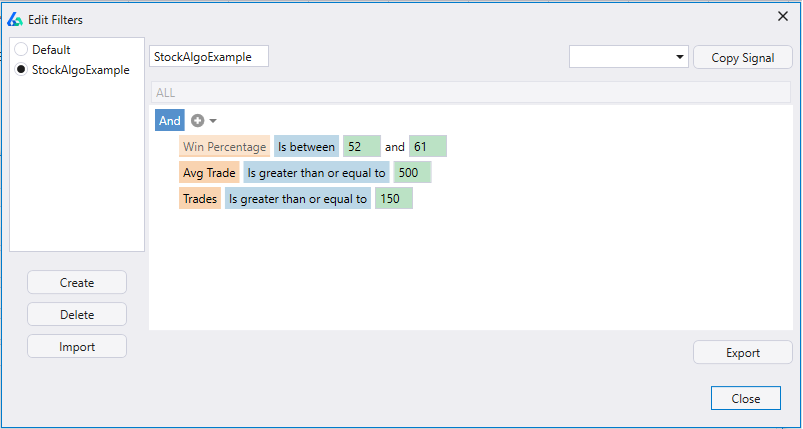

Step 3 – Automated Strategy Filtering Save time during the strategy development process by having Build Alpha only return trading systems that meet your pre-defined performance metrics. There are tons of built-in metrics to choose from.

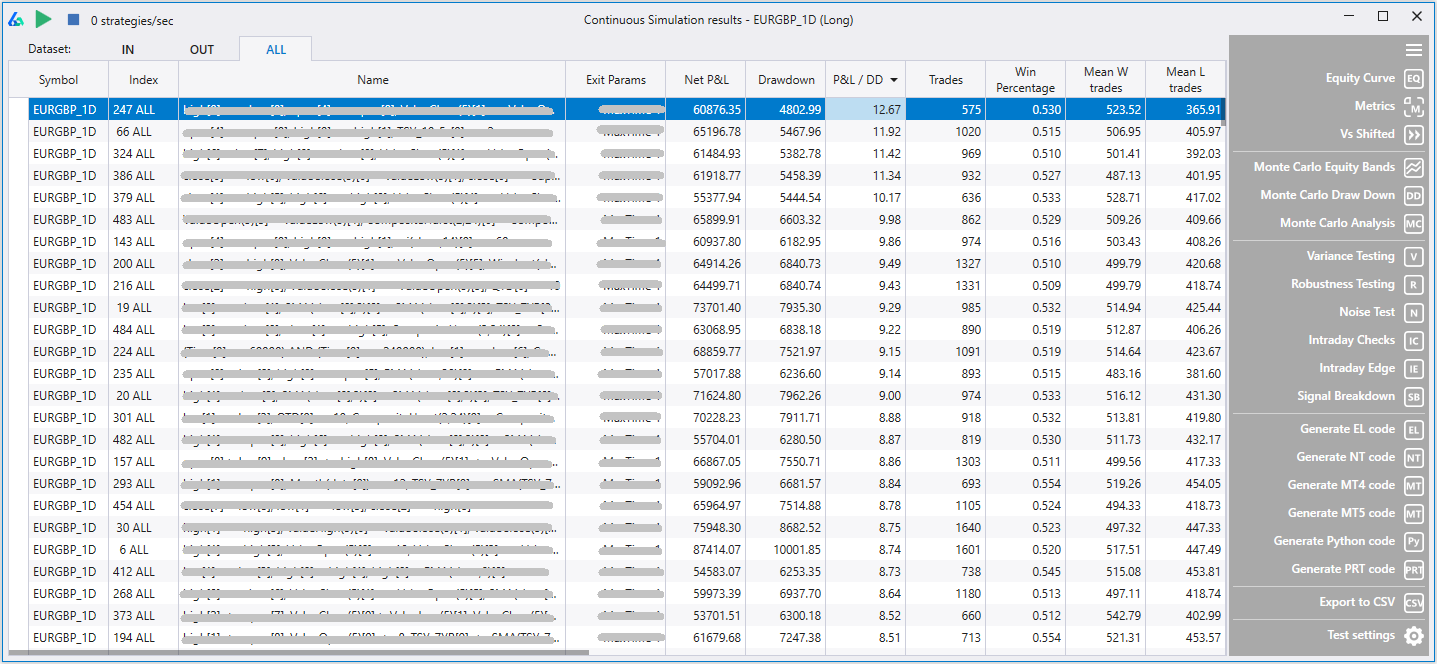

Step 4 – Simulate Hit Simulate and Build Alpha’s genetic algorithm will begin generating strategies for you. The machine learning will begin to analyze your inputs, the historical data, and start building the best algorithmic trading strategies that meet your requirements. The results window will continuously update with better strategies and can be paused or stopped in the upper left-hand corner anytime.

Step 5 – Validate Backtest results are known to lie to traders. Build Alpha is widely considered the best algorithmic trading software because it is uniquely equipped with institutional grade robustness and stress tests. These validation methods help identify strategies that are more likely to continue their performance.

Read the complete Robustness Testing Guide here.

Forex Trading Features

Time Filters and force end of day exit

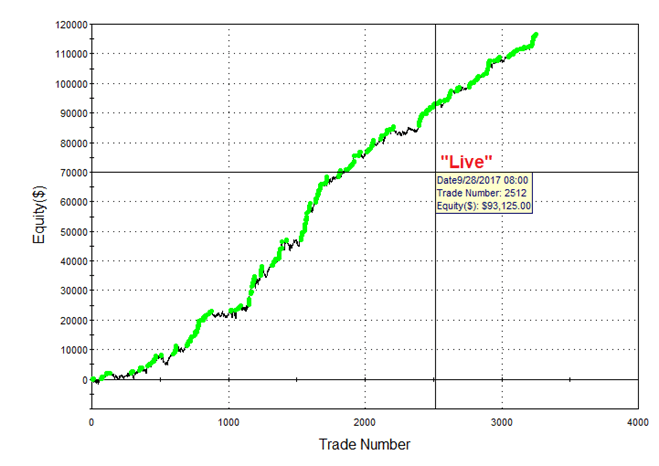

Forex trading presents different opportunities throughout the day as Asia, Europe and America wake up, go to lunch, and go to bed. Some of the most reliable FX patterns are centered around time of day. I released one of the most popular intraday algos here and you can see the performance since 2017 publishing.

Build Alpha enables you to set and require time filters so buy and sell orders are only issued when desired. You can also turn on and off the force end of day exit option which forces a trading system to close all positions at a pre-determined time.

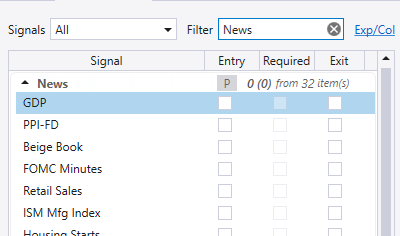

Economic Data and events

Currencies move primarily due to macro factors like interest rates and economic news. Build Alpha has a full library of historical and updating news events and economic data such as:

- Gross Domestic Product

- Nonfarm Payrolls

- Consumer Price Inflation

- Purchasing Manager’s Index

- Fed and FOMC Interest Rate Decisions and Minutes

- Treasury Auctions

- Factory Orders

- Consumer Confidence

- and more

You can now build algorithmic trading systems that avoid these new releases or capture the volatility around these events. To find the available testable news events in the platform simply type ‘News’ into the Filter window. You can then build strategies that trade N days before or after news events or various other ideas.

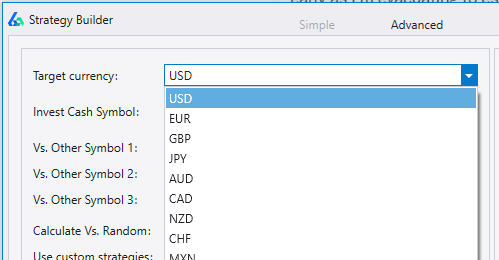

Multiple Account Currencies

Build Alpha caters to independent and professional traders all around the world. That being said, there is support for multiple account values or ability to view performance in your desired currency. In the settings menu, the trader can choose his default account currency. A few shown below.

Advanced Charting and Automated Technical Analysis

FX traders and algorithmic trading system developers rarely see eye to eye on trading tools as the former often prefers fancy charts and trendlines and the latter is looking for objective data to determine an edge in the market.

However, Build Alpha has quantified and made chart patterns testable. FX traders can now easily select all FX symbols and their favorite chart pattern and test its profitability, adjust stops, add targets all point and click.

Here is a quick 12 second video showing how to select all FX pairs and the ascending triangle pattern using a 2 ATR stop and a 2.5 ATR profit target. Click image to view.

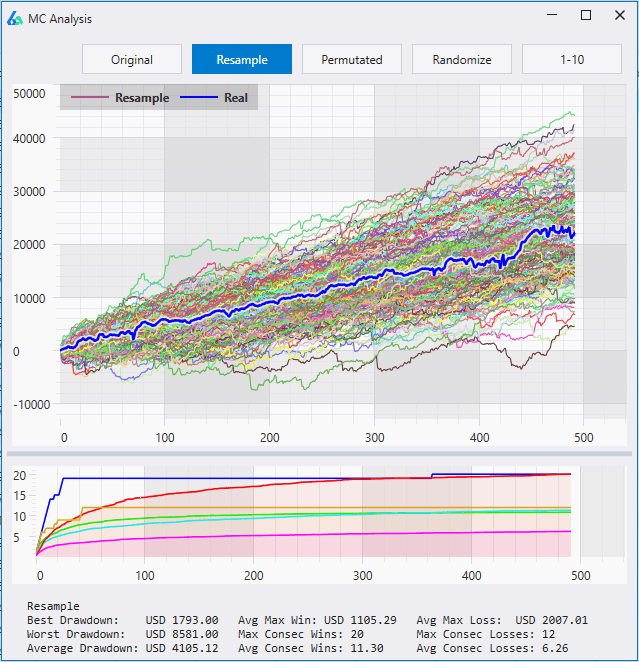

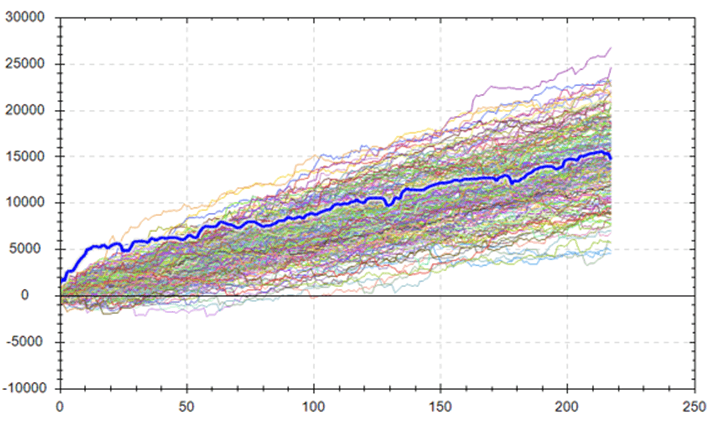

Monte Carlo Simulations

Trusting automated trades can often be difficult without proper testing and dissecting of the trading algorithms being used. Simulating a strategy over various market conditions and risk events can often be gamed and provide misleading results. Experienced traders know better and employ various validation methods.

The most popular methods are typically Monte Carlo Simulations which inject randomness into the trade results or market data to produce new equity curves. This can help better determine the possibilities of drawdown or the sequence trade returns may follow.

Build Alpha has various Monte Carlo Tests available at the click of a button including

- Monte Carlo Reshuffle

- Monte Carlo Resample

- Monte Carlo Permutation

- Monte Carlo Randomized

- Monte Carlo 1-10

- Monte Carlo Equity Bands

- Monte Carlo Drawdown Testing

All of which are explained with examples in this Monte Carlo Simulation guide.

Computer Specifications for using BuildAlpha

Strategy generation and the genetic algorithm can take various amounts of time and often depend on a handful of factors:

- Computing power (number of CPUs, CPU speed, RAM, hard disk speed)

- Amount and interval of your data

- Parameter and variable complexity

- Number of signals and settings selected

However, in short, Build Alpha needs about 8GB RAM. The better your CPU or the more cores you have the faster Build Alpha will operate. Build Alpha splits the task at hand across all available CPU power to speed things up.

Integrations for Automated Trading

Build Alpha generates fully automated code for all trading strategies at the click of a button. But what trading platforms can you use this code? There are code generators for the following platforms

- MetaTrader4

- MetaTrader5

- TradeStation

- MultiCharts

- NinjaTrader8

- Pro Real Time

- and more

Additionally, traders can monitor their strategies live in Build Alpha using the built-in data connections. Traders can connect to TradeStation, QuoteMedia, Binance or Interactive Brokers to receive real-time prices, live P&L updates, and position changes to their saved strategies.

Frequently Asked Questions

How much data is available?

Daily FX data is included and goes back decades for each pair. There is 1 minute data going back to 2006 in the database subscription offered with the Build Alpha license. Users can also download free data or import from their broker or provider.

Can I Import my own data?

Yes, Build Alpha accepts data in both txt and csv format. There are also various converters for the most popular platforms. If you have a question about getting your custom data into Build Alpha, please send me an email. I am sure it is possible!

Are there sample strategies to start?

Yes, there is a starter pack of ten simple strategies that come with the license. There are also various strategies on the blog and private forum. However, these strategies are meant to be building blocks and not meant for copy trading or blindly following trading bot service. This type of behavior is dangerous to a trading account and how many lose money!

Can I edit transactions costs like slippage and commissions?

Yes, absolutely. Slippage and commission are customizable in the settings menu. You can also choose to apply the spread or transaction cost on a percentage basis or on the total notional value of the trade.

Can I do Intraday or Day Trading Strategy Development?

Yes, Build Alpha is intraday automated trading software, too. There are specific features designed for day traders or intraday strategy development. Below is a short-list:

- Force End of Day Exit – turn on or off to avoid overnight trading

- Time windows – set specific hours to permit trading

- Intraday Edge – search for profitable intraday windows from a daily strategy

- Intraday Algo Hidden Checks – find optimal number of trades per day, max P&L per day, times to trade, etc.

Does build alpha support crypto trading?

Yes, Build Alpha does. You can also get live and historical data from Binance with a few other connections coming soon.

About Build Alpha

Build Alpha is a no code strategy builder and algorithmic trading software designed by David Bergstrom. David has spent the last decade-plus in the professional algorithmic trading world working with high frequency trading firms, hedge funds, and registered investment advisors (RIAs). His experiences and mentor have led to a series of repeatable processes to find, create, test and implement algorithmic trading ideas in a robust manner. Build Alpha is the culmination of this process from idea to execution.