Ensemble Strategies [Reduce Overfitting By Combining Strategies]

What is an Ensemble Method?

“In statistics and machine learning, ensemble methods use multiple learning algorithms (trading strategies in our case) to obtain better predictive performance than could be obtained from any of the constituent (individual strategies) learning algorithms.”

A simpler example would be to consider it as a voting system. Imagine 3 SPY strategies. In theory (and every individual case needs tested), if one strategy says long and the other two say flat (or short) then long is not a very confident position. On the other hand, if two or all three strategies say long then it is a more confident long entry.

It is also important to point out or imagine the market as a living breathing organism that is constantly evolving and dynamic in nature. So imagine having a strategy on Oil, Gold, Bonds and Stocks. Now you can get a better picture of what is happening in individual markets and how their combination or interaction can help predict what to do next in a stock index or the US dollar strategy, for example.

This is slightly different than intermarket strategies because intermarket strategies simply include ‘signals’ from secondary markets. Ensemble strategies are actually using the strategies themselves which undoubtedly carries more information than just the signals themselves.

Ensemble Strategies in the real-world and Finance

The first example, is about the Netflix challenge where Netflix offered a million dollar prize for the “best suggested movies to watch” algorithm. Jaffray Woodriff, founder and CEO of Quantitative Investment Management ($3B in AUM), competed in the contest and took 3rd! Woodriff is a big proponent of ensemble methods and mentions such in his Hedge Fund Market Wizards chapter of Jack Schwager’s great book. The team that actually won the contest was in a close race with the second-place team and wound up running away with the first-place prize by using an ensemble method applied to the other top 30 competitors’ models. I am trying to convey financially incentivized practicality here; the story comes from Ensemble Methods in Data Mining by Giovanni Seni and John Elder with a foreword by Jaffray Woodriff.

Ensemble Strategies and Trading

The two main things that plague trading strategies are

- Underfitting (bias)

- Overfitting (variance)

In the latest book sweeping the Quant world: Advances in Financial Machine Learning, Ensemble Methods have their own dedicated chapter! In this chapter, the author Marcos Lopez de Prado (head of AQR’s machine learning division and formerly founded and led Guggenheim’s Quantitative Investment Strategies that had over $13B in assets) states,

“An ensemble method is a method that combines a set of [weak] learners… in order to create a [stronger] learner that performs better than any of the individual ones. Ensemble methods help reduce bias AND/OR variance”.

So ensemble methods can help reduce overfitting? That sounds desirable for every system trader I know!

Quick Ensemble Tips

- Ensemble strategies will be better the more diverse the individual strategies. For example, use one strategy that looks at volume, one that looks at price action, and one that looks at spreads or intermarket signals.

- Do not try and ensemble very poor individual strategies and expect miracle improvements. Simple ensemble methods such as bagging, cannot improve the accuracy of such poor systems. So, you still have to put effort in designing the individual strategies! Ensembling is not a shortcut that can turn dirt into gold; however, it can polish up some things very nicely.

- Finally, ensembling (with bagging) is more likely to be successful in reducing variance (overfitting) than reducing bias (underfitting). This attacks the BIGGEST problem we have as system traders and developers.

Ensemble Strategies and Trading in Build Alpha

We can now select individual strategies that we want to use in the overall simulation. This means we can build strategies that only take a position when another strategy has an existing position. This is a great way to create hedging strategies (more on this in a later post/video).

The above ‘signal’ (if used) would only enter a trade when our strategy ‘SPY Strategy3 Trend’ has an existing position. This is a simple way to build hedgers, or use confirmation from other strong systems.

If you mark strategies in your Build Alpha portfolio as ‘Active’ then they can be used in ensemble strategies. The below selected signal would only enter a position when at least 2 (any 2 of your active strategies) already has a position. You can also select all the ‘at least’ signals and have the software find the best combinations of your existing strategies to use in an ensemble strategy.

This new feature in Build Alpha gives system traders an unique advantage never before offered. We can now create ensemble strategies at the click of a few buttons and completely automate them.

How Can I Make Ensemble Strategies Only Using The SPY Strategies?

If you have a few diverse strategies in your portfolio and want to create an ensemble only using a few of them then make sure the strategies you want to include in the ensemble are the only ones marked active in your portfolio. Below I’ve only marked the SPY strategies as active in my portfolio (left photo). Then when I select at least 2 on the right photo it means it will trade whenever at least 2 of the SPY strategies are in a position.

How Can I Make Ensemble Strategies Only Using The Non-SPY Strategies?

Simply change the active strategies in your portfolio by unselecting the SPY strategies and selecting the others.

How Can I Make Ensemble Strategies Using All The Strategies From My Portfolio?

You guessed it… just mark all as active. Now all strategies in our portfolio will be considered for ensemble strategies in Build Alpha’s strategy building process.

Note the above green box with the 1004 + 1000 numbers. This means that I have selected 1000 technical signals to use in the strategy building process plus 4 ensemble signals. I have also selected 1000 technical exit signals to include in the strategy building process. Now Build Alpha will create the best strategies it can given your inputs. You can also right click to ‘require’ any signal (including ensemble signals) to force the software to use that signal in the strategy building process.

Small Accounts

Ensemble strategies are great for smaller accounts too. If you cannot afford to trade multiple strategies, but have created a few then you can still capture the information of all the strategies by ensembling them into one ensemble strategy. Then you can trade this ‘master’ strategy with a smaller account than trading all the individual components. So better use of capital and less overfitting? Sounds good.

Ensembles: A Case Study

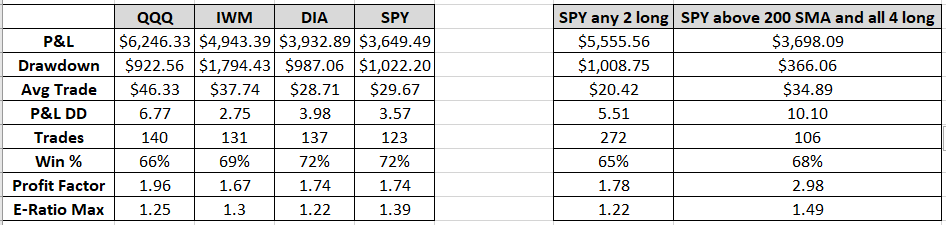

This is a simple case study showing the RSI2 strategy outlined in Larry Connors’s book Short-term Trading Strategies That Work. I have applied the strategy to the individual equity index ETFs and then shown the results of two different ensemble strategies of these four strategies applied to SPY.

The first ensemble strategy takes a position in SPY whenever two of the four individual RSI2 strategies have an existing position. It does not matter which two markets are trading at the moment, but it will trigger a SPY trade. This first ensemble strategy does better than three of the four individual components on most metrics, but specifically profit and loss to drawdown ratio.

Furthermore, if we look at the second ensemble strategy that only trades SPY when the RSI2 strategy has an active trade in all four of the equity indexes AND SPY is trading above its 200SMA then we can improve the profit and loss to drawdown ratio to over 10! Significantly better than any of the individual strategies.

Ensemble Methods Summary

Ensemble strategies combine multiple strategies to create a more powerful ‘master’ strategy. Ensemble strategies help reduce overfitting (curve fitting) which is the biggest plague us system traders and quant traders face. They have been shown in real-life trading, financially motivated contests, and as well as with large hedge funds to be superior to simpler trading strategies and machine learning models. BuildAlpha can now help you build, employ and automate ensemble strategies with a few clicks. Private videos for users now up!

2018 Year End Update

It is becoming more and more commonplace for large quantitative firms to use ensemble methods.

The future (and even the present) of quantitative finance is the discovery and deployment of ensembles of many marginal edges – even weak predictors. These smaller edges will not attract academic or practitioner interest because they may not be sufficiently profitable on their own, but combined in an ensemble can be very powerful. It is even believed Renaissance Technologies had this breakthrough a while ago and that has manifested/propelled them into the greatest Hedge Fund of all time.

A small and anecdotal example is the year end performance of this popularized RSI2 trading strategy. The individual strategy ran on the single markets resulted in

- SPY -$17.5 per share traded

- DIA +$0.24 per share traded

- QQQ -$1.07 per share traded

- IWM -$20.50 per share traded

- Ensemble +$2.79 per share traded

An overall weak year for this strategy, but improved by the ensembling described above. Ensembles are just another tool in our arsenal with Build Alpha to build the trading portfolio we need! Cheers guys.

Thanks for reading,

Good article. I particularly like the point about reducing over fitting.

Cheers,

Ryan

Thanks great idea.