Algorithmic Futures Trading Software

Gain the ability to quickly test and improve your trading strategies to find the best entry and exit points. No coding required.

How Algorithmic Futures Trading works with Build Alpha

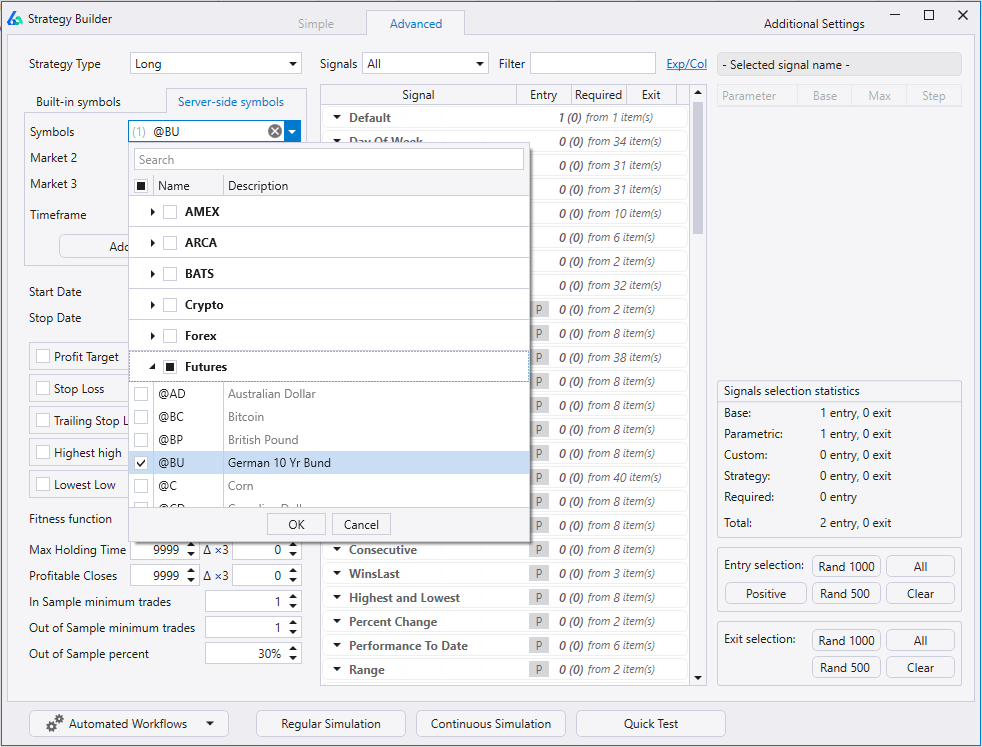

Step 1 – Symbol and Timeframe Selection Select the futures symbol or symbols you will build automated trading strategies for. Selecting a single symbol will return the best results for that symbol. Choosing multiple symbols and Build Alpha will return the best trading systems that work across that basket.

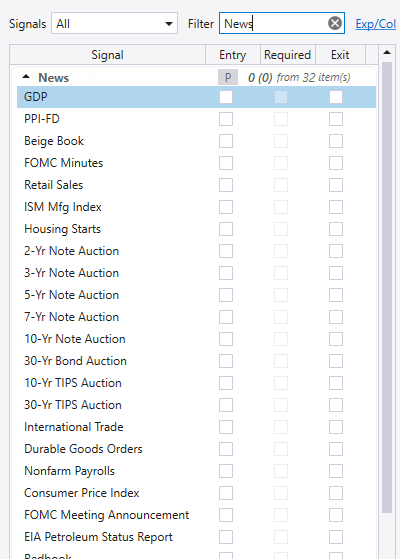

Step 2 – Entry and Exit Signals Build Alpha has over 6,000+ entry and exit signals to choose from. All signals can be used as either an entry or an exit and attempt to cover every aspect of the market. Here is a short list of available signal categories:

- Seasonality, time of day, weekday, month, quarter

- Price Action, Candlesticks, Chart Patterns

- Volume, Relative Volume, Volatility, Average True Range

- Technical Analysis and Technical Indicators

- Market Breadth, TRIN, Tick, Dark Pool Index

- Market Sentiment

- Economic Events and Data such as GDP, Nonfarm Payrolls

- FOMC and Fed Meetings and Minutes

- Option Flows and Gamma Exposure

- Treasury Yields and Spreads

- Vix, Vix Term Structure

- Holidays and other significant events

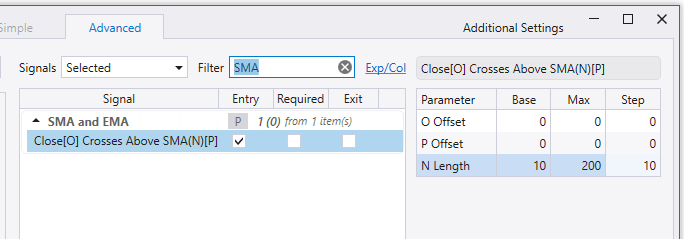

All signal lookbacks, thresholds, and values can be optimized. Parameter ranges can be customized and saved for each different signal. Build Alpha also has some popular signals hard-coded for quick use such as the 2-period RSI or 50-period simple moving average.

The above would check Close crossing the SMA with length from 10 to 200, incrementing by 10.

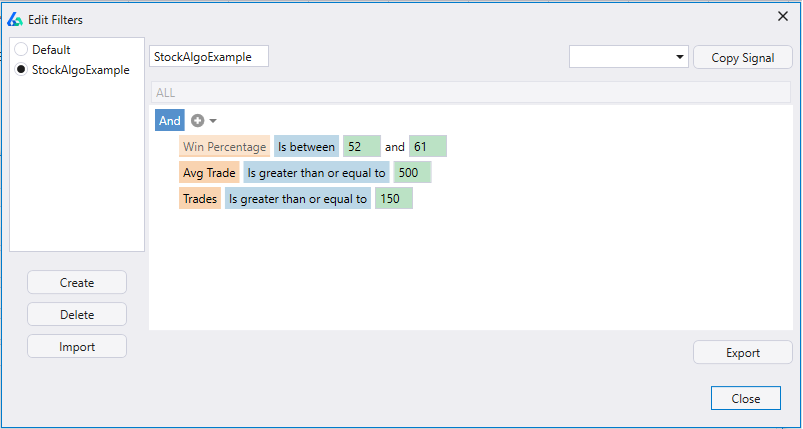

Step 3 – Filter Strategy Results Save time by having Build Alpha automatically discard strategies that do not meet your requirements. Set filters for performance metrics so that only acceptable algorithmic trading strategies are returned.

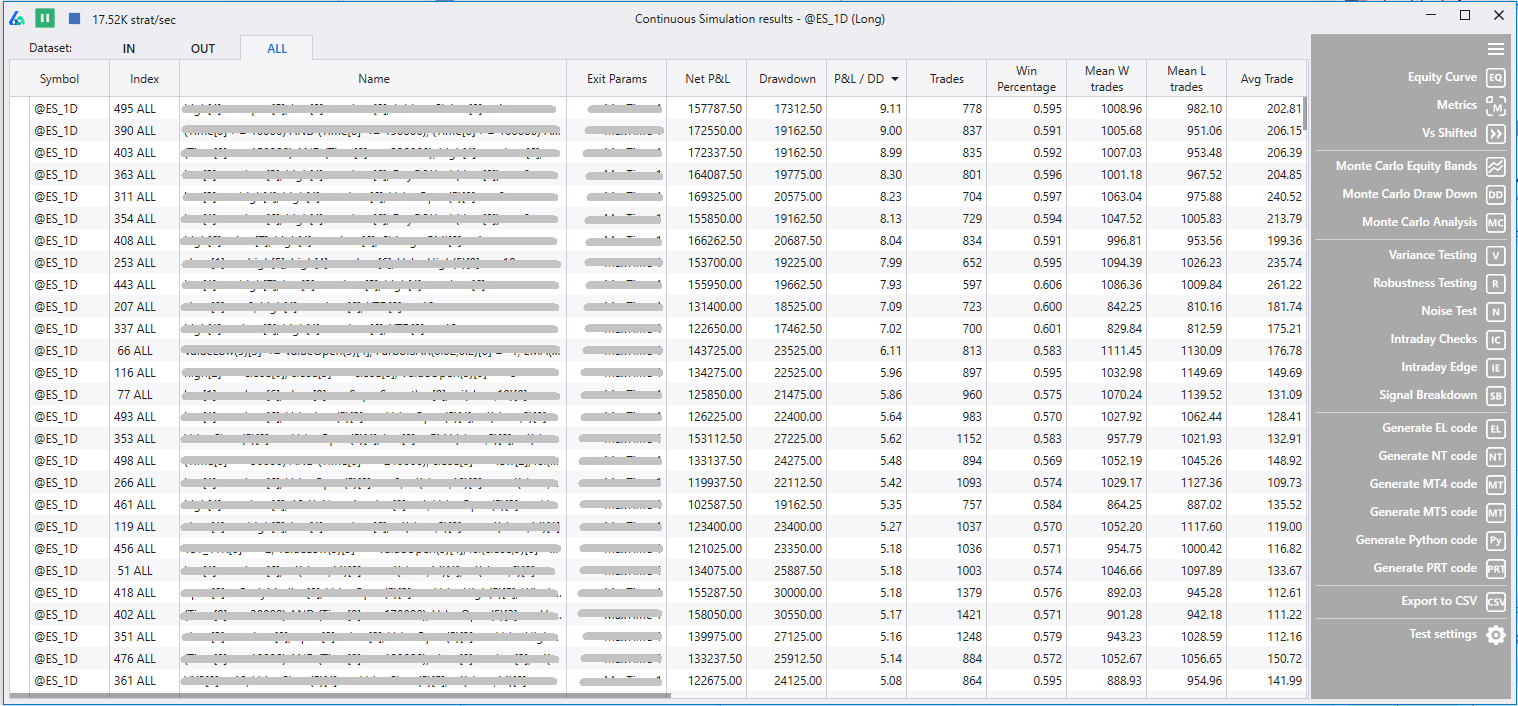

Step 4 – Simulate Build Alpha’s genetic algorithm will learn from your inputs, the historical data, and start building the best trading strategies. The best trading systems will be displayed so you can view the best results. The results window will continuously update with better strategies and can be stopped or paused at any time in the upper left-hand corner.

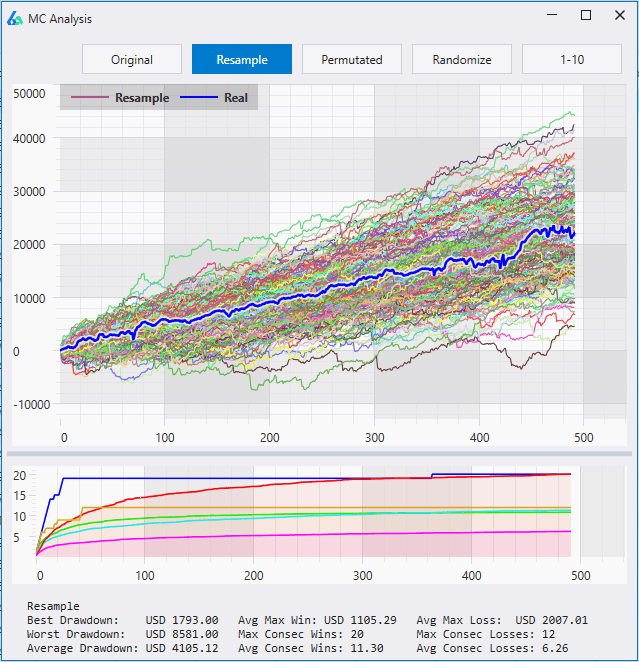

Step 5 – Validate A great backtest is often not enough. True edge is in understanding which strategies are statistically significant and present the best odds of continued performance on live data. Build Alpha’s suite of robustness tests and stress tests help identify such strategies.

Read these posts to learn more about Robustness Testing and Monte Carlo Simulations.

Futures Trading Features of Build Alpha Algorithmic Trading Platform

- Access to futures data, all timeframes

- Choose time windows and seasonality

- Economic Events and Data

- Add Additional Data

- Robustness Testing

- Rebalance Strategies

- Hedging and Ensemble Strategies

Access to futures data, all timeframes

The software comes with built-in daily data for 30+ popular futures markets. The monthly database subscription includes access to all timeframes. The intraday market data goes down to 1-minute and goes back to 2006. Daily data goes back to contract inception. This enables testing over a variety of market conditions. Tick data can be imported as can custom bar types such as Kase, Range, Volume.

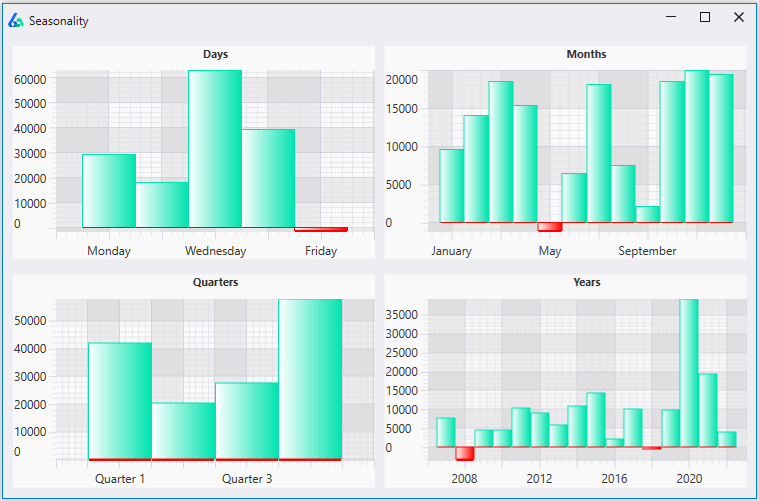

Choose time windows and seasonality

Customize permissible trading hours or restrict trading to certain windows. Develop a trading strategy for morning hours or to only trade during seasonally favorable times of the year. Analyze seasonal breakdowns and easily add rules to avoid trading in unfavorable times.

Economic Events and Data

Access to economic events and news releases allows you to create algo trading strategies that isolate news releases and time of day. For instance, Nonfarm payrolls and 8:30 AM ET could be inputs to developing a Jobs Friday trading system. Test how your strategies do around certain news releases.

Add Additional Data

Ability to import your own custom price or alternative data can help you dig deeper and find edges your competitors will not. Data can be added in the settings menu via txt or csv file following simple Date, Time, Open, High, Low, Close, Volume, Open Int format. If you do not have data for a certain column, then you can use dummy values or zeros.

Please note Build Alpha supports multi asset class portfolio management as well.

Robustness Testing

Finding good performing backtests or past performance is not enough for system trading success. Trading strategies must be robust and stand the test of time. Stress tests are critical to automated trading strategies and Build Alpha is widely considered the best algorithmic trading software among professional traders due to its large suite of Robustness Tests. Some of these tests include:

- Vs Random

- Vs Shifted

- Vs Others

- Vs Noise Adjusted

- Monte Carlo Simulations

- Variance Testing

- Delay and Liquidity Testing

- and more

Here is the full guide to Robustness Testing.

Rebalance Strategies

Finding good and robust strategies is one thing but finding the right markets to apply the strategy to is a whole other challenge. Build Alpha allows for Rebalance or Rotational strategies. This strategy type takes a basket of markets, ranks them, then applies the trading strategy to the top (or bottom) N markets until the next rebalance or ranking period.

The trader can test for optimal ranking methods, ranking frequencies, and assets to trade. This takes automated trading strategies one step farther than most.

Hedging and Ensemble strategies

Finding complementary strategies can often be a make or break to one’s trading account. Build Alpha allows the trader to use saved strategies as inputs to new strategies. The trading platform can search for strategies that only take a position when a saved strategy has a position. Or, on the other hand, an ensemble or voting strategy may only take a position when at least three or four saved strategies have a similar position.

Check this guide to read more on Ensemble Trading Strategies.

Requirements for using Build Alpha

The genetic algorithm and strategy optimizations can take various amounts of time and depend on a variety of factors. Here are the most significant:

- Computing power (e.g. number of CPUs, CPU speed, RAM size, hard disk speed)

- Amount and time interval of your data

- Complexity of your tests

- Number of variables or inputs

As a rule of thumb, Build Alpha requires Windows operating system and 8GB RAM. Build Alpha will also make use of all available CPU power and cores. A faster CPU and more cores will allow Build Alpha to achieve more and work faster.

Mac users can use Build Alpha with Build Alpha’s latest update or by using Parallels or another Windows virtual environment.

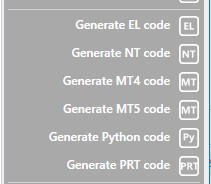

Best Algorithmic Trading Software Integrations

Build Alpha generates fully automate-able code for all trading algorithms for a variety of Futures brokers and platforms at a click of the button. The support platforms are:

- TradeStation

- NinjaTrader8

- MultiCharts

- MetaTrader4 and MetaTrader5

- Pro Real Time

To generate code for any strategy created by Build Alpha, simply highlight the strategy and click the code generator of your choice in the lower right of the results window.

Additionally, Build Alpha can connect to live data from TradeStation, Interactive Brokers, QuoteMedia, and Binance. This allows traders to view real-time position updates, live P&L, and receive alerts to saved algorithmic trading strategies.

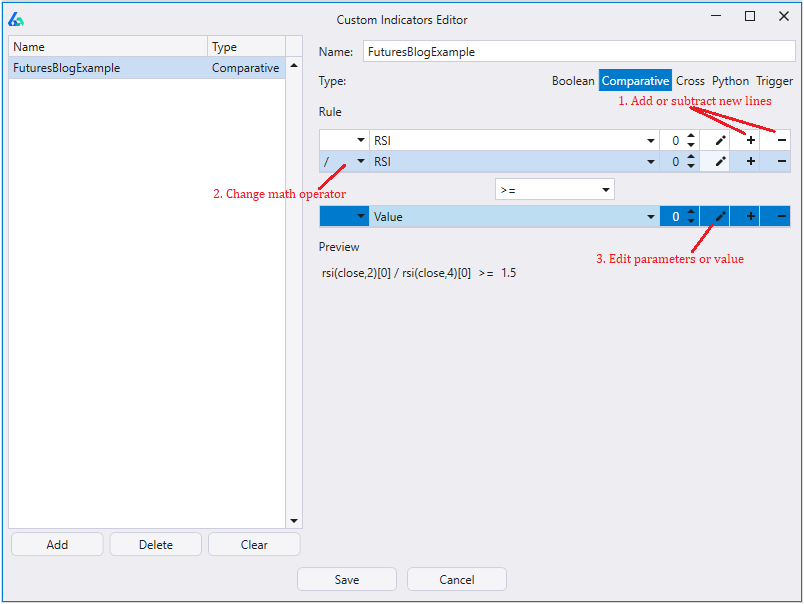

Custom Signal Editor in Build Alpha

Need to add a custom signal or edit one of the built-in signals? Maybe find a way to quantify something from your manual trading? Build Alpha provides a custom signal builder that requires no coding. You can combine indicators, comparisons, operators, math functions, and various parameter values to create any custom signal.

To create a custom signal, you can add new lines (1), edit parameter values (2), and change how the lines are compared (3).

To show the Custom Signal Editors flexibility, the above example divides the 2-period RSI by the 4-period RSI and will only trade when this value is greater than 1.5.

For those that want to add custom signals via code, Build Alpha can read python as well. Take a look at how to use python in Build Alpha here.

Frequently Asked Questions

What Futures Can I Test with Build Alpha?

You can test any futures market with Build Alpha. The most liquid or an obscure newly created market. Build Alpha has an option in the settings menu to adjust the margin, tick and point value, and data type. This helps the backend engine properly calculate profit and loss during strategy build. I aim to build flexible automated trading software.

How much data is included? Can I import my own?

Daily data goes back to inception and intraday data goes back to 2006 or over 15+ years. Custom data can be imported in the settings menu using txt or csv file formats. You can also connect directly to TradeStation, QuoteMedia, Interactive Brokers or a few others to pull data directly from their APIs.

Build Alpha supports all asset classes including forex trading, crypto trading, stock market algorithms, and other complex financial instruments.

Can I test Futures spreads?

Yes, there is no limitation to the data you can test as long as it follows the formatting guides that Build Alpha accepts. Date, Time, Open, High, Low, Close, Volume, Open Int. Any columns without data can be filled with dummy values or zeroes.

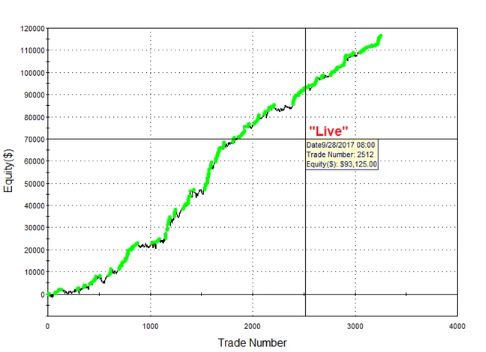

Do you have sample strategies for futures markets?

Yes, there are simple strategies on the blog, private forum, and a starter pack of ten simple strategies. These are not meant to be blindly followed or used for copy trading. These are meant to be building blocks or starting points. Here is a simple EURUSD futures strategy given away in 2017 that is still performing well (knock on wood).

Can I add transaction costs to backtesting?

Yes, both slippage and commissions are customizable in the settings menu. Adjust the fees to be per contract or based on notional value. Transaction costs and trade execution are often pivotal tests before live trading. Traders can also test various position sizing methods, risk management, and more from the settings menu.

Does this software work for intraday and day trading?

Yes, Build Alpha is the best algorithmic trading software for intraday trading. The database and software support any timeframe and there are unique features specifically for intraday or day traders.

- Time windows – limit trading to specific hours of the day

- Force end of day exit – turn on or off to avoid overnight exposure

- Intraday Edge Strategy Search – Find profitable intraday windows of daily strategies

- Intraday Algo Hidden Checks – test for max trades per day, max P&L per day, total trades, etc.

About Build Alpha Algorithmic Trading Software

Institutional grade trading tools like Build Alpha are created by David Bergstrom who has spent the last decade-plus in the professional algorithmic trading world working with high frequency trading firms, hedge funds and registered investment advisors (RIAs). Many of his experiences have led to a series of repeated processes to find, create, test and implement algorithmic trading ideas in a robust manner. Build Alpha algo trading software is the culmination of this process from start to finish.